With the second decade of the 21st century in the rearview mirror, the Worn & Wound editorial team thought now would be a great opportunity to take a look back at some of the key trends in the watch world over the last ten years. It was a period of great change in the industry, with social media becoming more critical seemingly by the week, and traditional points of sale in high end retail stores giving way to direct sales to consumers on the internet. And, of course, the micro-brand began to come of age, creating a vibrant culture around watches unlike anything the hobby has seen. In this two-part series, Zach Weiss, Ilya Ryvin, and Zach Kazan explore the last decade in watches, and how the last ten years may inform the next.

The Rise of the Micro-Brand

Zach Weiss

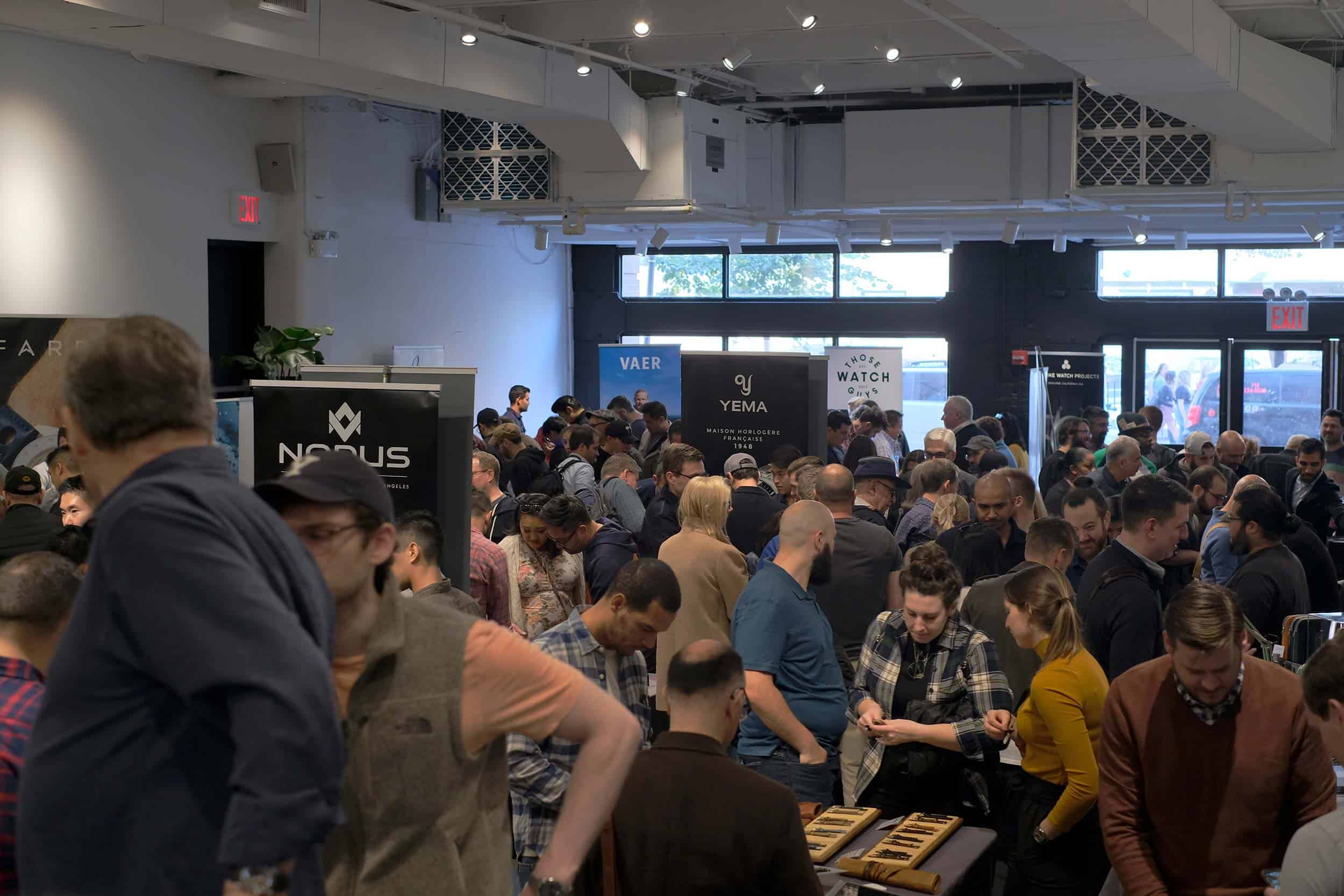

While there have been many significant moments, trends and shifts in the watch industry over the last decade, few have been so important to Worn & Wound as the rise of the micro-brand. Once quickly dismissed as a fad, micro-brands are a rapidly growing facet of the industry that only the most stubborn of industry veterans would deny. Small by definition, nimble, and not beholden to the same market pressures or margins as larger watch brands, micro-brands have been at the forefront of many trends, from smaller cases to the revival of vintage designs. In an industry where the household names have continually raised prices, leaving watch fans new and old behind, micro-brands came in to not only fill the void but to reenergize a generation of watch enthusiasts that had been shut out.

Featured Videos

Featured Videos