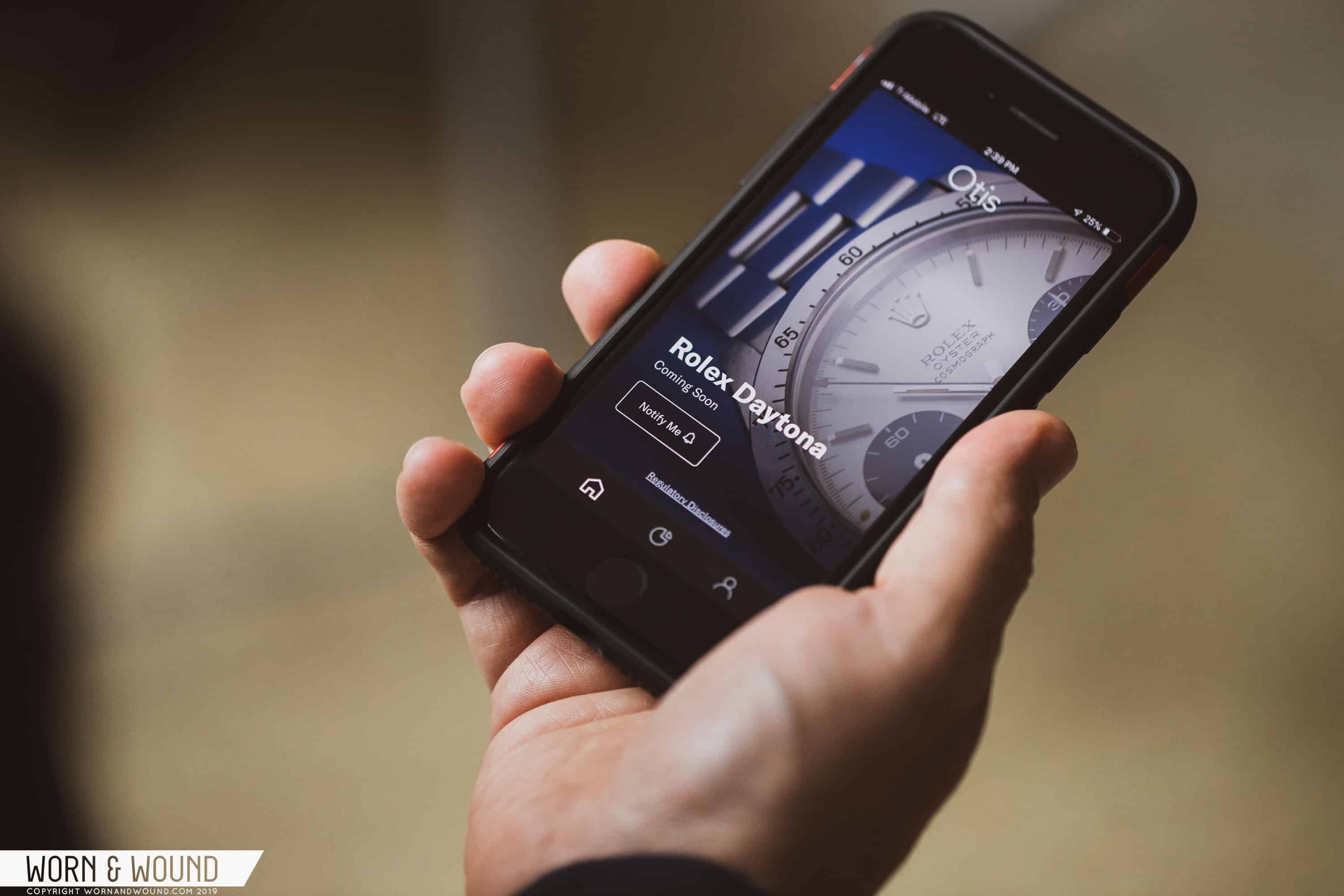

Would you buy a piece of a Rolex Daytona as an investment? Otis, a new app-based investment service that launched earlier this year, is banking on the answer to that question being yes. Just like one would buy stocks in a company, Otis allows users to buy stock in “culturally relevant commodities” — ranging from a painting by Kehinde Wiley and limited edition KAWS artwork, to the aforementioned Rolex Daytona.

Co-ownership platforms that treat “cultural” goods like publicly traded assets are nothing new. There’s Rally Rd. for cars, Mythic Markets for Magic the Gathering, among many others. But the same issues remain here — you’ll likely never see that Rolex that you purchased shares in unless you’re in New York City, where these items will be displayed in a gallery.

Of course, there’s also the investment aspect of the whole endeavor. One is far more likely to buy a share of that Daytona if they expect the value of that watch to appreciate over time, which it is likely to do. The biggest barrier here is the current lack of a method to establish a fair market value, but, according to a rep for Otis, an SEC-regulated exchange is the next step. I also inquired about asset liquidation, and if Otis had any predetermined timeframes for when they might sell an asset. The answer is that it is still being determined.

We’ve all seen the prices of certain vintage watches skyrocket in recent years, and the notion of watches as an investment drive large chunks of the vintage market. We’ve even heard from sources within the industry that there are investment funds structured around buying up hot-ticket watches. But for many of us, investing in six-figure watches isn’t realistic, so a democratized take on this idea is certainly something that piqued my interest. Whether this has long-term viability remains to be seen, but the underlying idea is nevertheless intriguing.

Is this something you would consider as a potential investment vehicle? Leave us your thoughts by dropping a comment below.

Featured Videos

Featured Videos