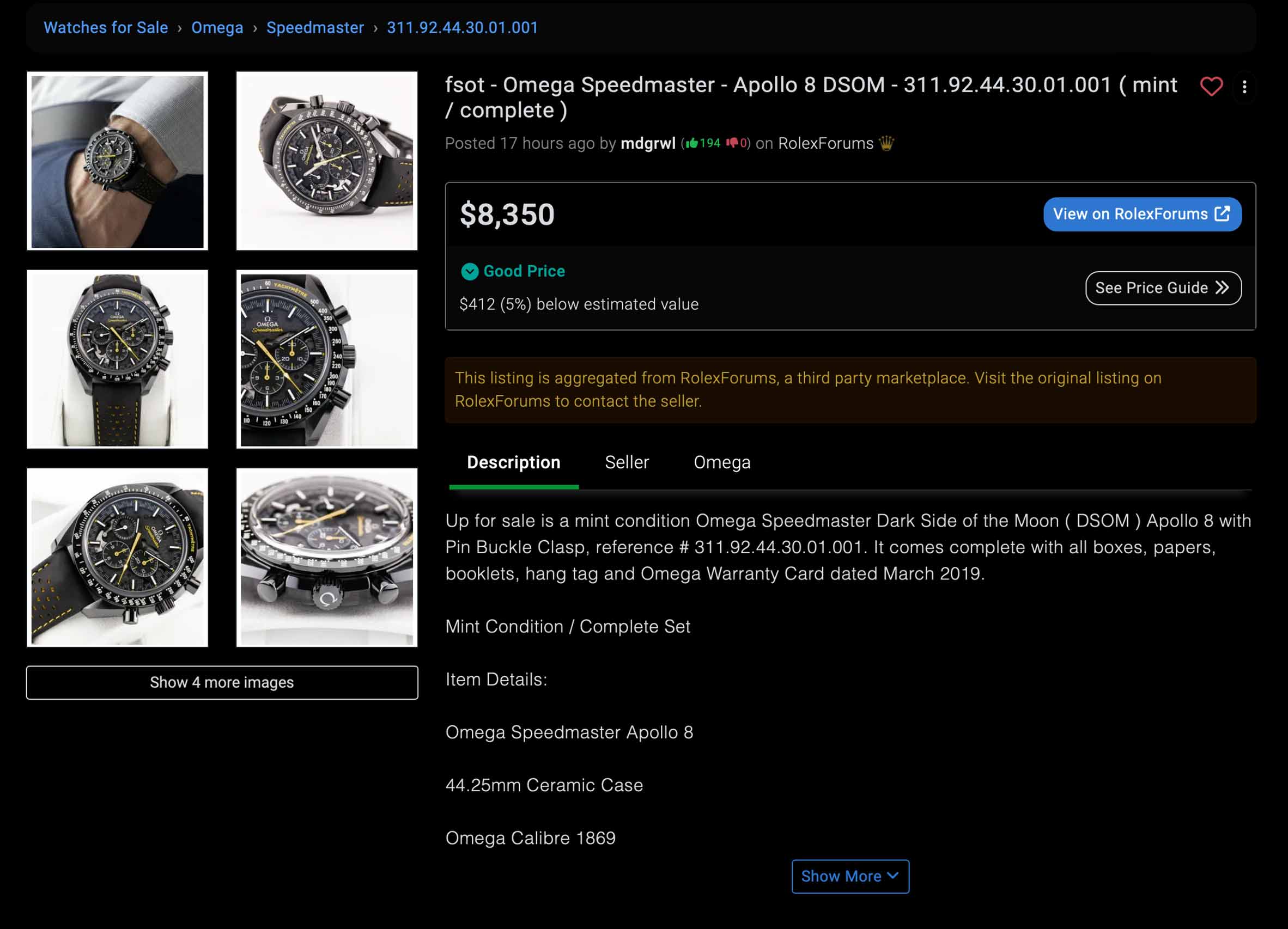

An all too common refrain from watch collectors is that the experience of buying a watch can be something of a headache. While you might be wined and dined if you buy directly from the boutique of a high end luxury brand, the reality is that most of us are hounding forums and enthusiast marketplaces trying to score a deal. But with the open market comes a lot of uncertainty. How do you know if you’re getting a good deal? And how do you know if the person you’re chatting with is going to send you more than an empty box?

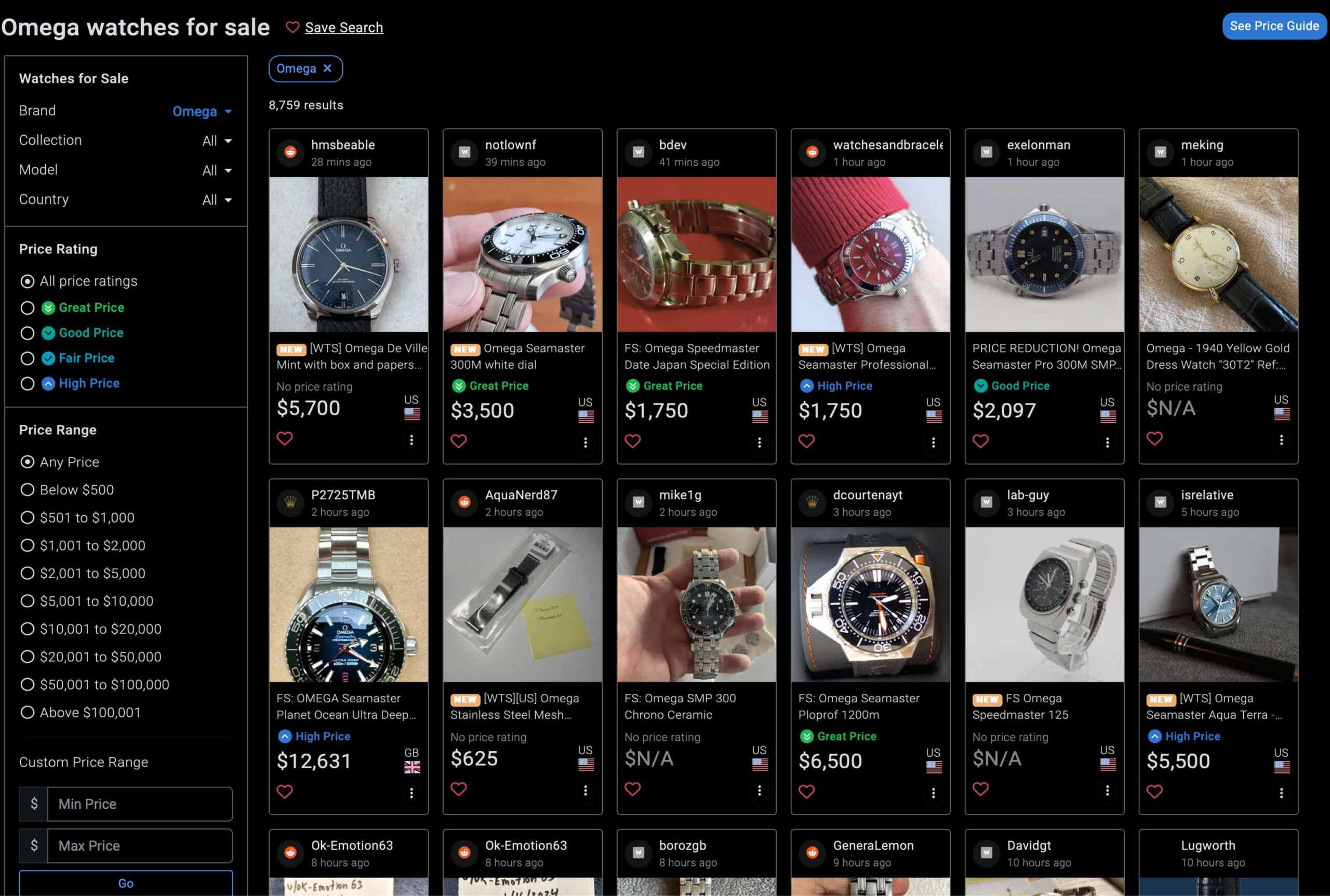

WatchCharts, the watch market research platform whose primary goal is to bring price transparency to watch consumers, recently launched their own buying and selling platform that seeks to alleviate some of the stress. There are a lot of buying and selling platforms for watches, so the addition of one more to the growing matrix of watch shopping options isn’t necessarily newsworthy, but the involvement of WatchCharts adds a new wrinkle to something that is so familiar to watch collectors that it’s part of the very fabric of the hobby.

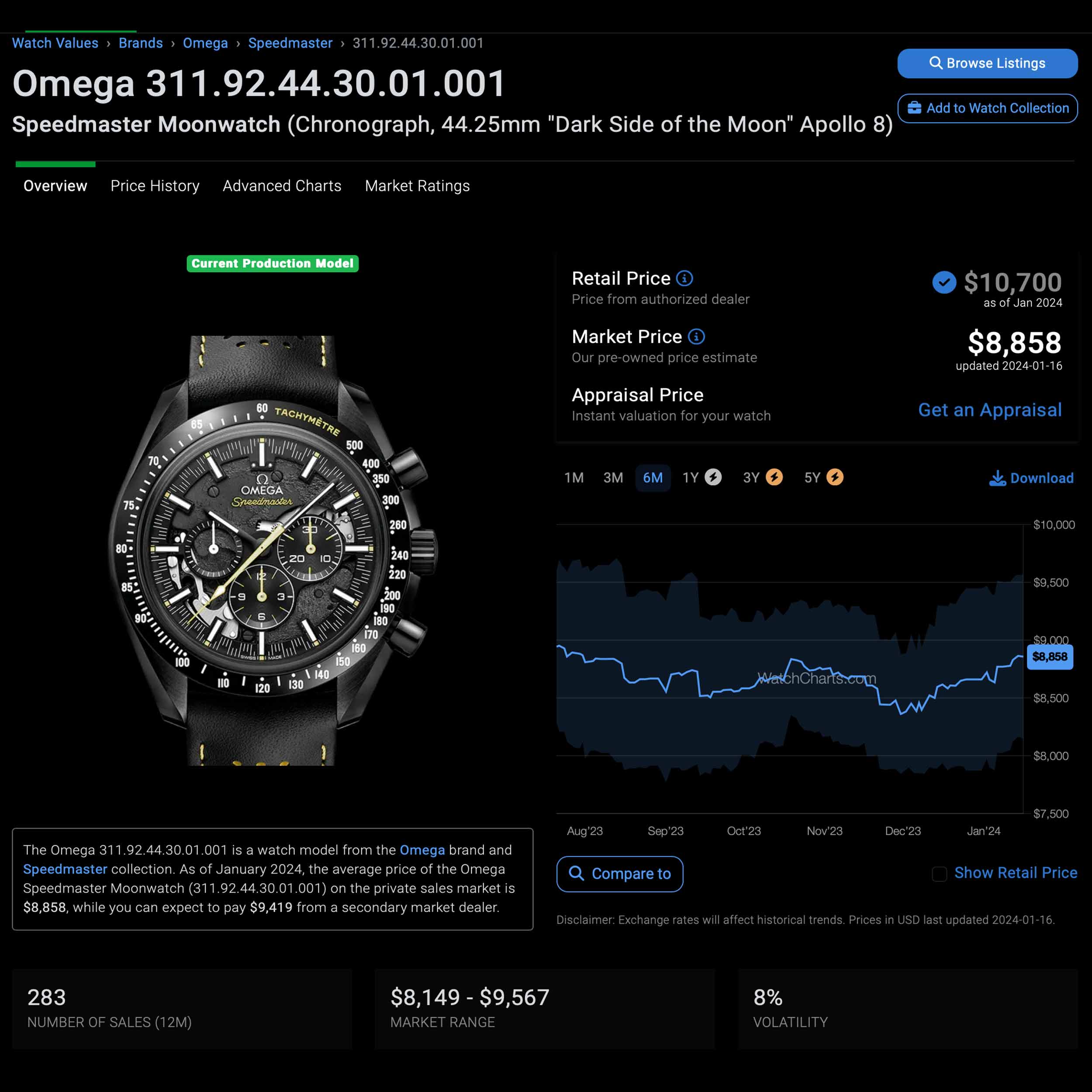

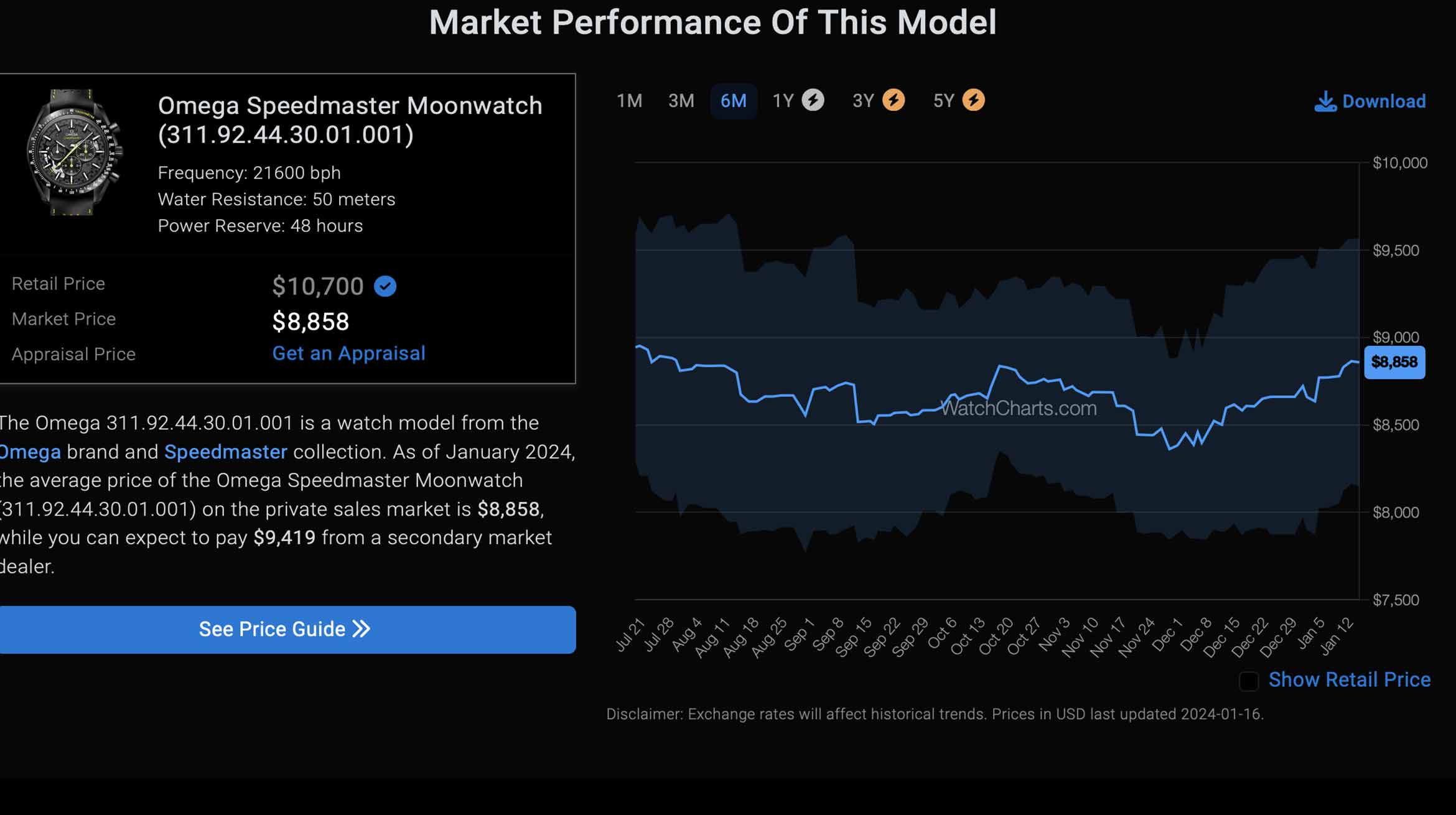

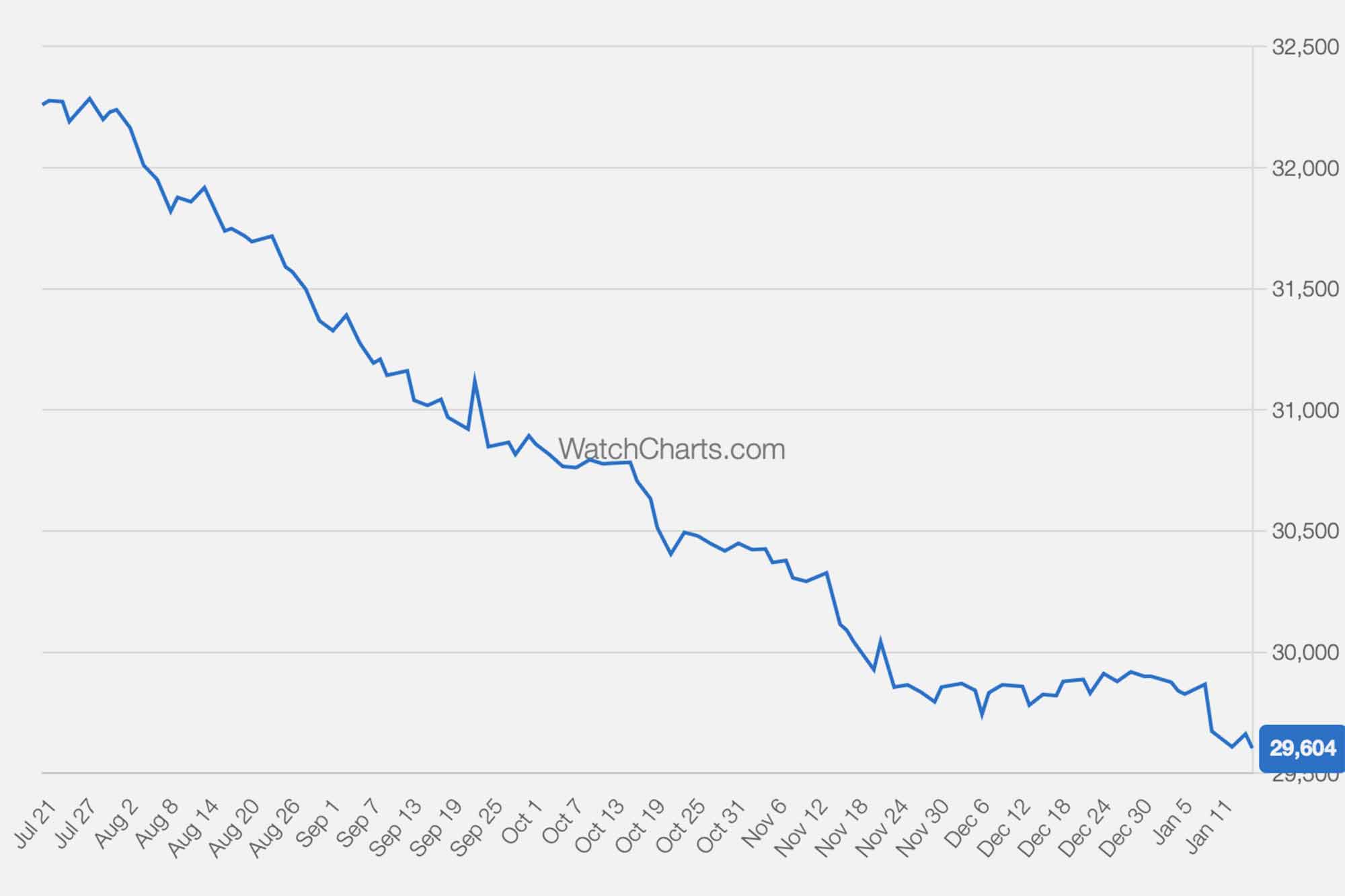

On the surface, WatchCharts Marketplace looks like any other buy/sell/trade platform. But under the hood, it’s leveraging WatchCharts data that collectors who use the platform will already be familiar with. “We’ve dedicated the better part of five years to collecting, analyzing, and understanding watch market pricing and trends,” said WatchCharts founder Charles Tian. “Many of the problems with the secondary watch market today stem from an imbalance of knowledge that is available to dealers versus collectors. Our goal is to empower collectors by bringing price transparency to every purchase and sale on our platform.”

Featured Videos

Featured Videos