The current trade war between the United States and China has been characterized by increasing tariffs since March 2018. Commercial goods were not initially a tariff target, with Chinese made aircraft parts, medical devices, and satellites bearing the initial brunt of the trade war. In a tit-for-tat back and forth that has lasted more than one year, products of all kinds now carry tariffs upon import from China, and consumer anxiety over the impact of the trade war on day-to-day purchases has become more severe.

The worldwide watch industry has thus far been largely unaffected by the growing trade war, and Reginald Brack, the Watch Industry Analyst for the NPD Group, doesn’t see that changing. “The proposed tariffs on Chinese imports should have minimal impact in the short term, and not much of a ripple effect on the Swiss watch industry.”

But the Swiss watch industry is only one part of a much larger story. China is a major player in the global watch industry, and is currently the world’s largest manufacturer and exporter of watches. Many of China’s watch exports are produced for large fashion brands. However, China is also a go-to resource for smaller enthusiast-focused brands based in the United States, who have employed Chinese manufacturing and supply over the last several years, some with great success. These largely independent watchmaking firms have varying degrees of exposure to the current trade war.

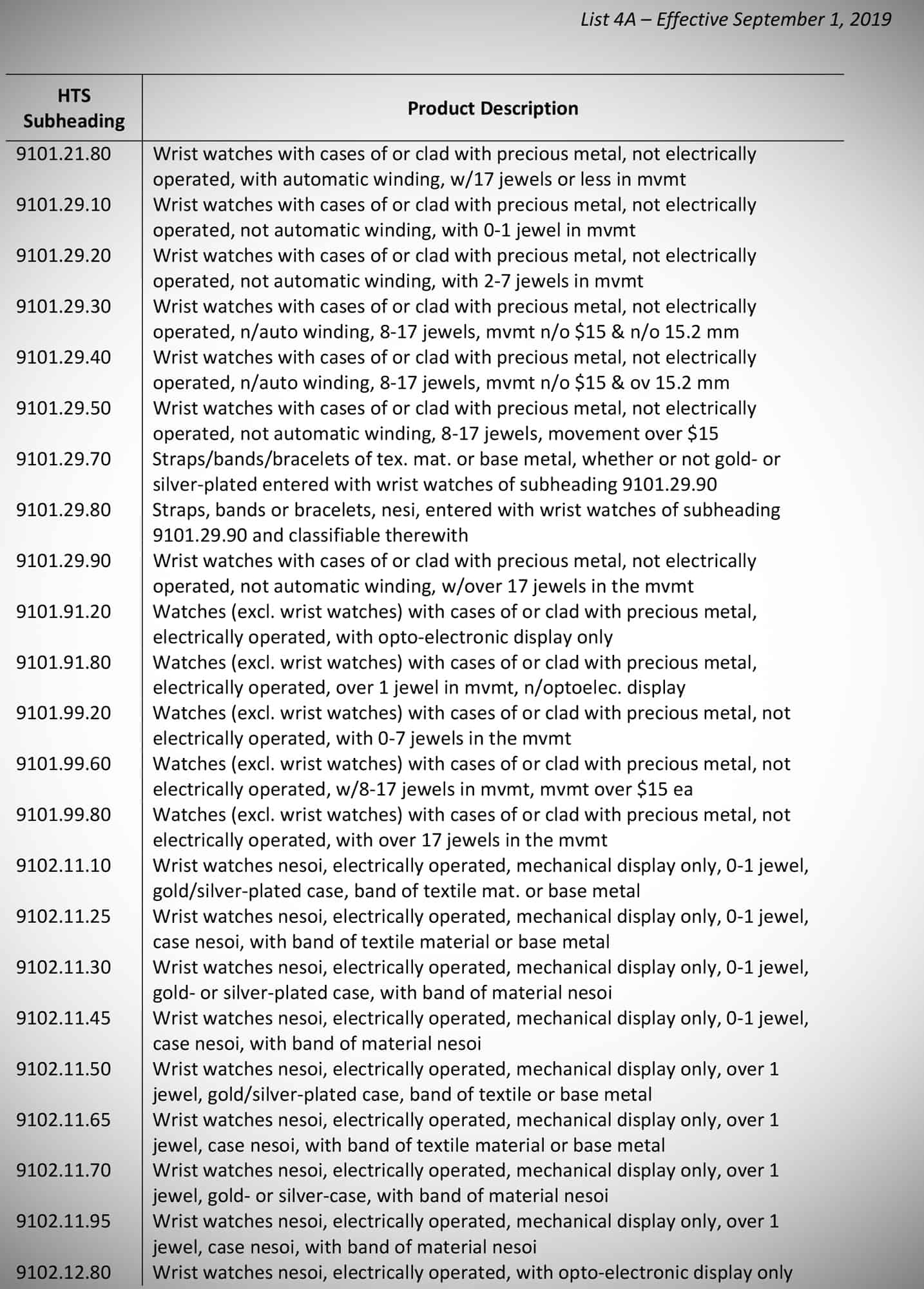

The List 4 tariffs proposed by the Trump administration have been the focus of media scrutiny and public debate since they were first announced. While the implementation of tariffs on consumer products such as apparel, toys, and cell phones has been delayed until December 15, some tariffs impacting the watch industry have just gone into effect. These include tariffs on completed watches, as well as a variety of components including watch crystals and piezoelectric quartz. For many small watch brands who rely on Chinese manufacturing and supply chains, these tariffs will have a substantial impact on their business in the short and long term.

Featured Videos

Featured Videos