Vintage watches are a hot topic these days. All you need to do is spend some time on Instagram, in the Facebook watch groups, or any number of high profile blogs (including worn&wound) to see incredible examples of horological art and function from decades ago. Part of the reason these watches are a hot topic is the fascinating history behind them. Not just the provenance or mystery/history behind individual watches, but the history of the brands too.

To that end, this is the first of a (hoped for) series of articles on those histories. We’ll hope to entertain you a bit, and add to your knowledge of things horological as seen through and told by the roles these brands played.

Certainly, at this point in history, there is no bigger player than the Swatch Group. These days, because of the brands they own and the efforts of ETA (which the Group also owns) to limit distribution of ébauches (unassembled, unfinished movements), they’re the 800 pound gorilla in the industry, and all eyes are on them.

So we’ll start there.

The history of the Swatch Group is really the history of two companies and the leadership of two men.

In 1931, to counter the effects of the Great Depression and “maintain, improve, and develop” the Swiss watch industry, the Swiss government and the country’s banks assisted in forming ASUAG – Allgemeine Schweizerische Uhrenindustrie AG. As we’ll learn in a bit, this was not to be the last time the Swiss banking industry held major sway over the Swiss watch industry.

ASUAG gradually accumulated numerous companies who manufactured ébauches and movement parts. In addition, the company had formed a subsidiary, General Watch Company, in 1971. General Watch Co. was a holding company for several brands which manufactured complete watches, that ASUAG had acquired over the years.

The brands of General Watch Co. were A. Reymond S.A., Atlantic S.A, Certina, Diantus, Edox, Endura, Eterna, Hamilton,Longines, Microma, Mido, Oris, Rado, Roamer, Rotary, and Technos. (Several of those brands, A. Reymond S.A., Atlantic S.A, Edox, Eterna, Oris, Rotary, and Technos, were subsequently spun off and made independent again or were sold.)

The brands of General Watch Co. were A. Reymond S.A., Atlantic S.A, Certina, Diantus, Edox, Endura, Eterna, Hamilton,Longines, Microma, Mido, Oris, Rado, Roamer, Rotary, and Technos. (Several of those brands, A. Reymond S.A., Atlantic S.A, Edox, Eterna, Oris, Rotary, and Technos, were subsequently spun off and made independent again or were sold.)

SSIH, on the other hand, was the result of a merger of sorts between Omega and Tissot which occurred in 1930. Omega was to concentrate on the luxury segment while Tissot would focus on the midrange. The two were joined two years later by Lemania Watch Company and A. Lugrin Co. Ultimately, SSIH would become the third largest manufacturer in the world, behind Timex and Seiko.

The philosophy both ASUAG and SSIH followed was to counter the economic crisis and accompanying unemployment of the 1920s by streamlining R&D efforts within the brands under their respective umbrellas. This unfortunately, was easier said than done. Subsidiaries being what they are, both companies struggled to implement common policies and procedures. By the 1970s, both companies were in crisis.

The Hamilton Electric watch had made its appearance in 1957 and the Bulova Accutron tuning fork watch followed in 1961. Together they were harbingers of things to come a decade and a half down the road.

The early 1970s brought what we now call the quartz crisis: the arrival and near-immediate dominance of inexpensive and accurate quartz watches from Japan. ASUAG and SSIH both responded. Each made gallant attempts to segue to the new technology. Indeed, Omega and Longines had made inroads in electronic timing. Witness their efforts at sports timing, where Omega especially had distinguished themselves with their Olympic timing efforts.

The economic situation (double-digit inflation and a weak dollar) in the United States, the biggest importer of Swiss timepieces at the time, did not help. Not even a 1980 bailout to the tune of $150 million from the Swiss banking industry could help SSIH.

In spite of their quartz efforts, both SSIH and ASUAG were ultimately too late to the dance. With a different economic and financial infrastructure than their Japanese competition, both were soon facing bankruptcy and subsequent liquidation. Competitors were circling like sharks.

Enter two men, Dr. Nicolas G. Hayek and Ernst Thomke.

Nicolas Hayek was a self-made multi-millionaire and founder of Hayek Engineering AG, a business and technical consultancy. Hayek and his firm were instrumental in several Swiss business reorganizations throughout the 1970s.

In 1979, a banker friend asked Hayek to develop a plan for selling ASUAG and SSIH to the Japanese. Hayek was outraged. The Swiss were set to capitulate, willing to throw in the towel and let 200+ years of heritage and world leadership in watchmaking and high horology slip into history without much more than a whimper.

Instead, Hayek prepared what came to be known as the Hayek Study. In it, he made a number of recommendations for streamlining and redefining the Swiss watch industry. Chief among those recommendations was to merge ASUAG and SSIH. The banks agreed and Hayek headed the committee overseeing the merger. The two were merged into SSIH/ASUAG Holding Company in 1983. Hayek was named Chairman of the Board of the newly formed company.

Running a close second was Hayek’s recommendation to develop and introduce an inexpensive Swiss-built quartz watch. This was to be the so-called second watch – because the vast majority of people only owned one watch. This new watch would be cheap enough to be affordable, and would also be designed as a fashion accessory. Hayek hoped this new second watch would succeed well enough to provide breathing room and financial resources for SSIH/ASUAG to return Switzerland to watchmaking glory.

At this point, reports differ regarding this more radical recommendation. Most say the banks went along with this plan. At least one maintains they were not so agreeable.

Regardless, Hayek then looked to Ernst Thomke at ETA, who had the watch ready and waiting.

Thomke had served an apprenticeship as a mechanic at ETA SA early in his career. In 1978, after a successful stint in marketing and economic management in the pharmaceutical industry, he returned to ETA to oversee the revamping of the movement manufacturer. He managed the consolidation of the many small manufacturers scattered around the country, and helped introduce manufacturing automation. At the same time, he saw to the development and manufacture of quartz movements. In 1982, he was appointed to the Board of Directors of ASUAG, which by then owned ETA SA and sister movement manufacturer Ebauches SA.

Following his return to ETA, Thomke and his team had developed the Delirium, a watch less than a millimeter thick. Thinness was a Holy Grail for forward looking watch brands in those days. The Delirium was a success, but at $5000 per unit, it was not to be a financial savior. So Thomke turned his attention to using the Delirium’s manufacturing techniques to developing an inexpensive quartz watch. He viewed the salvation of ASUAG and SSIH as the route to saving ETA. If either failed, it would likely be the end of ETA as well.

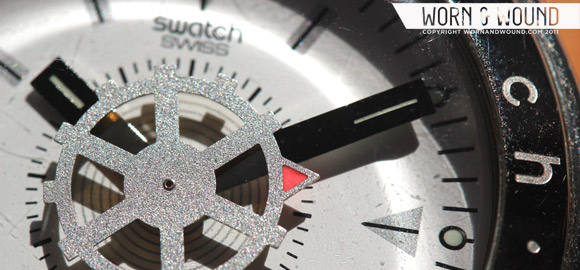

Thomke, along with two associates, Elmar Mock and Jacques Müller, developed a new and very inexpensive to manufacture quartz timepiece consisting of only 51 parts (Swatch would pay homage to this fact thirty years later with the release of the Sistem51, a mechanical watch with only 51 parts). Thus was born the Swatch brand. The name was a contraction of Hayek’s Second Watch.

When the SSIH/ASUAG Holding Company was created, Thomke was installed as its first CEO, serving from 1984 to 1991.

Around this time, the banks backing the whole venture offered Hayek a 51% stake in SSIH/ASUAG Holding Company for CHF151 million. Hayek agreed, pulled together a consortium of investors and consummated the deal in 1985.

In 1986 the SSIH/ASUAG Holding Company became SMH – Société de Microélectronique et d’Horlogerie. That year, overall revenues for the company were CHF1.25 billion. With revenues at that level, SMH set about redefining the Swiss watch industry as a high end luxury industry. Thus, it pulled itself out of competition with the cheaper Asian segment. SMH brands themselves were energized and revitalized.

In 1992, SMH acquired Blancpain, which had long been dormant. Hayek, along with Jean-Claude Biver and Hayek’s grandson Marc worked to revitalize the brand, which now produces around 30 watches per day.

The company name was changed again in 1998, this time to Swatch Group Ltd. This was in homage to the brand that effectively financed the whole revitalization of the company.

In 1999 Hayek made an impassioned decision to acquire Breguet. The company was then held by a consortium in Bahrain, which was doing nearly nothing with the brand. Hayek installed himself as CEO and set about rebuilding the brand to what he perceived to be its proper place in the pantheon of historic brands.

As the newly named Swatch Group entered the new century, they acquired Glashütte Original, which was the privatized German brand Glashütter Uhrenbetrieb GmbH.

Tragically, but somehow fitting, Nicolas Hayek died suddenly while at work in the offices of The Swatch Group in June of 2010. He has had his critics, but it’s tough to deny his pride in his adopted country of Switzerland, or his role in saving the Swiss watch industry.

Hayek’s son, Nick is now CEO of The Swatch Group and President of the Executive Group Management Board. Daughter Nayla is also active in the management of the Swatch Group, serving as Chair of the Board of Directors, and as CEO of Harry Winston.

The real story – and a true irony – of the creation of the Swatch watch, is that it ultimately became the salvation of the Swiss mechanical watch industry. In the first full year of production, 1983, Swatch sold 1.1 million units. Three years later, that number had jumped to 12 million. Today, overall revenues for The Swatch Group are approaching CHF9 billion.

Not bad for an industry that was on life support with a “Do Not Resuscitate” order from its own government in 1979. Thank God Nicolas Hayek ignored that order.

by Ed Estlow

sources:

http://www.swatchgroup.com/en/group_profile/history

http://papers.ssrn.com/sol3/papers.cfm?abstract_id=634566

http://magazine.wsj.com/features/behind-the-brand/time-bandit/

http://www.fundinguniverse.com/company-histories/the-swatch-group-sa-history/

http://www.mattbaily.ca/en/blog/2008/09/18/nicolas-hayek-the-man-who-saved-swiss-watch-indust/

http://en.wikipedia.org/wiki/Nicolas_Hayek

http://en.wikipedia.org/wiki/Ernst_Thomke

Featured Videos

Featured Videos