On Thursday 15th January, while the rest of us were innocently checking the time on our mostly Swiss watches, an explosion reverberated around the usually quiet valleys of Neuchâtel; the Swiss National Bank binned its currency peg against the Euro.

“Currency, shmurrency.” you might think. But, at the stroke of a second hand, a Swiss watch that cost $100 to produce on the 14th of January jumped to around $115-120.

Normally, watchies can happily get on with enjoying things that tick without worrying about the esoterics of currency markets. But this is serious.

What actually happened?

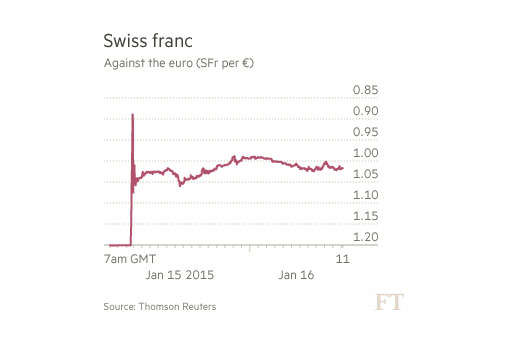

In forex markets, movements of a couple of percent make currency traders jump. Without its cap, the value of the Swiss Franc went up like a cablecar – by 30%. And manufacturing costs went with it.

That initial rise against the Euro wiped nearly 10% off the value of the SIX (the Swiss stockmarket). And watch businesses – who export the majority of the watches they make – were hit hard. Richemont’s share price dropped 14% and Swatch Group shares fell 15% with its CEO, Nick Hayek describing the Bank’s action as starting a “…tsunami”. He’s put his price rises where his mouth is too. Swatch Group have just raised prices on Breguet, Longines and Omega of between 5% and 10%.

What does it mean for the watch industry?

The issue is the number of watches running Swiss – particularly ETA – movements. They’re almost ubiquitous. From the humble workhorse quartz to a chronometer-grade mechanical movement, the prices of making and assembling them has soared. And they’re found in watches from almost every major manufacturer at prices from $10 to $10,000+. It would be incredible if some of those manufacturers didn’t pass on the costs to watch buyers.The industry doesn’t – yet – have a united front, despite accounting for 10% of Switzerland’s exports. The pain is there – clearly – for the ateliers. The question is will they – can they – pass the cost increase on to consumers?

At the top end of the market, the CEO of Parmigiani, Jean-Marc Jacot, says watchmakers can absorb the increase and cut their margins. Swatch Group – for all M. Hayek’s protests – and Rolex probably have enough fat to do so.

Audemars Piguet’s Francois-Henry Bennahmias took the view that prices would need to ‘adapt’ with prices rising in Europe. With a currency movement like that, the ‘adaptation’ is only going one way for the rest of the world too.

Whatever the level of adaption, the challenge will be for smaller firms who often don’t have the margins to cut. That means the host of tiny Swiss businesses who rely on stable labour costs to supply the big makers with balances, wheels, screws and other parts. They won’t be able to afford to be so sanguine if the big brands try to scrape their margins to make up for the currency movement.

And neither will the small watchmakers. Edouard Meylan, Chief Exec of tiny 55-man H. Moser & Cie sums up the position of many smaller watch businesses:

“…why not just move 2 kilometres into Germany and continue business as usual in the EU? …around 20% of my employees are German.”

It could be that the sleepy German town of Glashütte is about to get rather busier. After all, Nomos has been producing watches that ace the Swiss in Germany for years. If the Franc doesn’t settle back, there really may be some firms upping benches and moving over the border. They may certainly look to site expensive labour and cost-intensive processes there.

And what about the watchmakers outside the Eurozone – in the UK and USA- who use Swiss parts and movements? They’ll be paying more for the movements they modify and case, so expect to see rises there too.

Then there’s the future of external partnerships in the Swiss watchmaking industry. There have been some splendid collaborations between British makers and Swiss movement workshops – Bremont and La Joux-Perret, Christopher Ward and Synergies Horlogères for example. 2012 already saw the worst year since 2005 for foreign direct investment. A strong Franc isn’t exactly going to see money pouring into watchmaking businesses to back innovation. It’ll be a tragedy if the new landscape means fewer new, innovative movements.

But, in reality, this is a rise that’s been coming for some time. The currency movement simply provides manufacturers with a clear reason to take their red pencils to the price lists.

Jonathan Bordell, MD at UK watch business Page & Cooper, is looking at things differently and his own views are pretty clear. “The value of Swiss watches is exceptional. When you look at the level of workmanship, time and care that goes into something like a Squale or a Sinn or a Damasko, the wonder is they’ve not risen in price before. The currency movement will just accelerate what was already going to happen. The big boys will simply use higher prices to differentiate themselves.”

How about for watch buyers?

Well, if you live in Switzerland you’re onto a winner. Take your Francs, nip over the border into the Eurozone before prices rise and trouser a 20% saving on the new price of a Swiss watch. If you’re in the rest of the world, without a stash of Swiss Francs, things don’t look quite so rosy. M. Jacot’s ‘adaptation’ is going to hurt. The markets are still settling and will be for some time to come, but it’s unlikely that Swiss watch prices are going anywhere but north.

There’s not even good news for buyers of sub $1,000 watches. After all, a $200 increase is as tough to stomach on a $1,000 watch as a $2,000 hike on a $10,000 one.

What are the alternatives? Not every good watch is assembled within sight of an alp. Some makers have been using Japanese and other Far Eastern movements for years. With flatter prices, mechanical movements from Miyota, Seiko and Seiko-owned Orient are going to look very much more attractive to watchmakers. The Miyota 9000 series is already finding its way into watch cases that would traditionally have been home to Swiss motors.

And with the current low Yen and no rises in the Euro, A Grand Seiko or a Nomos has never looked such good value. And for American brands like Autodromo who mostly use Japanese movements, this is only going to be good news.

With their frequent price rises and moves towards restricting parts supply, few independent watchmakers or watch buyers will weep for the large Swiss groups. But it seems pretty certain that “Swiss Made” on the dial is now going to come with a rather stiffer price tag.

Featured Videos

Featured Videos